Daily loans have gained immense reputation amongst people in search of flexible financing options. They offer fast money circulate options for numerous needs, similar to emergency expenses, bill payments, or sudden monetary burdens. Unlike traditional loans, day by day loans require shorter reimbursement durations, making them an appealing selection for so much of. This article will delve into the intricacies of daily loans, discussing their advantages, potential drawbacks, the appliance processes, and how the best sources – just like the Betting web site – can present priceless info and critiques associated to daily lo

Many lenders also assess the character of your business and industry. Certain sectors are deemed higher risk, which could affect your eligibility or the phrases of the mortgage. Being well-prepared along with your financial paperwork and a transparent business plan can considerably improve your possibilities of appro

The convenience of no-visit loans is maybe their most important benefit. Borrowers can apply at any time from wherever, eliminating the want to take day with out work work or rearrange schedules for in-person conferences Loan for Bankruptcy or Insolvency. This flexibility cannot be understated in today’s fast-paced wo

Furthermore, the competitive nature of on-line lending has prompted many lenders to supply favorable phrases, such as lower rates of interest or no fees for early compensation. Borrowers should take the time to shop round to find the very best deals, as the market is increasingly saturated with choi

Additionally, some lenders might require a steady checking account and proof of identity, ensuring that the borrower is a respectable Loan for Low Credit for Bankruptcy or Insolvency candidate for the loan. It's essential for applicants to evaluate these standards rigorously earlier than making use of to keep away from pointless rejections, which may further harm their credit score scores. Remember that even without a job, people can nonetheless qualify for certain kinds of loans if they meet different criteria successfu

Choosing a lender for a no-visit loan requires careful consideration. Start by researching varied online lenders and comparing their provides. Key components to gauge embrace rates of interest, reimbursement phrases, and any additional charges that may have an effect on the entire value of the mortg

The reimbursement interval for business loans varies significantly primarily based on the mortgage sort and lender. Short-term loans might require repayment within a few months to a 12 months, whereas long-term loans can span several years, typically ranging from three to 10 years. Understanding the reimbursement terms is significant to ensure the mortgage aligns together with your business’s money m

Once permitted, the lender provides the mortgage settlement, which ought to be reviewed carefully. Understanding the reimbursement terms, rates of interest, and any associated fees is crucial earlier than signing. If satisfactory, the borrower can accept the phrases and await the disbursement of fu

Moreover, 베픽 excels in providing person testimonials and critiques, offering real experiences from borrowers who've utilized No-visit Loans. It serves as a valuable tool for individuals seeking to consider totally different lenders and discover the most suitable choices for his or her wa

Advantages of Daily Loans

Daily loans provide several advantages, making them attractive choices for those in pressing want of money. Firstly, their quick approval times enable debtors to safe funding almost instantly, which is a big benefit in emergencies. Additionally, every day loans usually contain minimal documentation, lowering the bureaucratic trouble associated with traditional loans. Furthermore, many lenders offer versatile compensation choices, catering to the person wants of borrowers. This adaptability can significantly reduce the stress that usually accompanies monetary difficult

To choose a reliable lender, conduct thorough analysis. Look for lenders with constructive critiques, clear terms, and licenses to operate in your state. Websites like 베픽 can provide important insights and comparisons that can assist you make a well-informed determinat

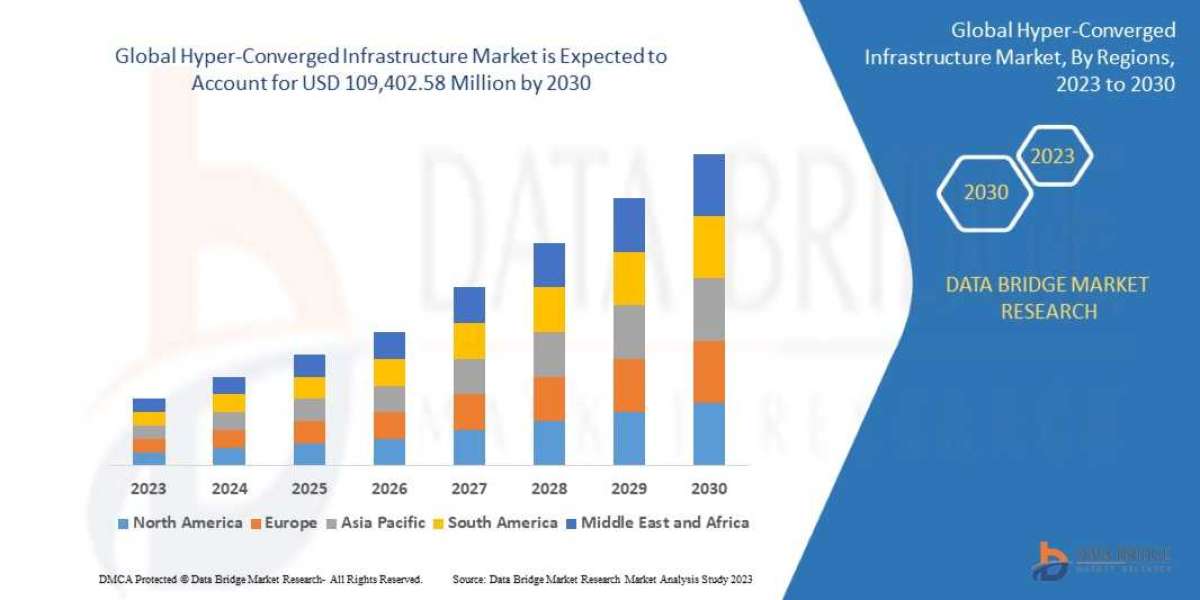

In today's dynamic monetary landscape, securing funding via a business mortgage has turn out to be essential for lots of entrepreneurs and small business homeowners. Whether you are trying to expand operations, manage working capital, or put money into new projects, understanding the nuances of enterprise loans is essential. This article aims to interrupt down the elemental aspects of business loans, discover various sorts, and spotlight how services like 베픽 can help you on this journey. With complete data and informed critiques, 베픽 is your one-stop vacation spot for exploring the myriad choices available within the realm of enterprise fina

Challenges and Considerations

While enterprise loans offer considerable advantages, they aren't without challenges. Mismanagement of borrowed funds can result in financial distress, emphasizing the necessity for careful planning and budgeting. Additionally, companies must stay vigilant in opposition to taking up excessive debt, which might hinder growth and sustainabil

josephinesanso

17 Blog posts